The visionary tech streamlining our vehicle repair industry

Launched in 2009, the National Accident Repair Group has established one of the leading vehicle repair networks within the UK.

Witnessing the company’s growth over the last 14 years, Managing Director Malcolm Banner has been instrumental in spearheading the technological advancements to enhance not only National but their customers’ business setup.

How has tech has positively impacted the automotive repair sector?

In this article, we talk about all things tech with Malcolm and how it’s positively impacting the automotive repair sector.

What is the importance of technology at National and in the automotive industry?

From early on, we knew that to navigate the vehicle repair sector, many parties have to communicate with one another effectively. From policyholders and insurers to repairers and management groups such as ourselves, we must be on the same page. When challenged with external factors such as market upset, industry delays, increased prices and world events, having the technology to manage your internal factors is essential for longevity and development.

What operational pain points have you seen in the vehicle repair sector since the beginning?

Insurers were experiencing an increasing pain point of losing repair work simply because they couldn’t deploy a claim as quickly as needed. In an era where customers want immediate solutions, implementing the right software systems enabled insurers to connect with reputable repair centres in real time. The first step was to give our customers the latest deployment technology; now, we’re at a phase where a complete repair journey needs to be visible to all parties involved; long gone are spreadsheets of customer data. Artificial Intelligence is playing a big role in our future plans, and that will only improve our operational processes and communication touch-points moving forward.

It’s been four years since Silverstone Software was established. What’s the link with National?

After a spell of outsourcing IT solutions, we identified a gap within the National Accident Repair Group, where we could offer and oversee an in-house software management solution. In 2018, we established Silverstone Software, a software agency with the vision to solve and support automation processes for all parties involved in vehicle repair.

What is the current setup for Silverstone Software and National?

Silverstone Software is a core part of our service and plays a key role in our customer’s day-to-day operations. Four years on, we’re developing the most innovative software to reduce repair cycle times and provide expert service for our customers and their policyholders. Silverstone Software manages the entire National digital programme, including maintenance, tech support and new project development. During 2023, we employed six new software engineers based in Northamptonshire to extend our software capabilities, such as .NET services and bespoke system builds in Microsoft technologies.

As your customer network grows, how do you manage a software rollout?

Our bespoke systems seamlessly integrate with our customers’ IT platforms via API connectivity or through a web browser viewpoint. We can easily link to insurers’ own claims setup, or we can install our own platform, which requires limited development. This means no downtime, information is shared securely and quickly between organisations, and the IT setup is simpler. As I mentioned, Silverstone Software’s role is to support and manage the IT transition with the option for customer training and bespoke platform alterations.

How is AI utilised in your industry, and does National have any plans for this emerging technology?

When real-time data is essential to the success of claim deployment and repair cycles, AI works in our favour. Silverstone Software is currently looking into ways to move our intelligent deployment system (IDS) forward. Due to the amount of data we handle, we’re investigating ways to effectively use AI across our core systems, with a plan to implement AI in 2024. From an operations perspective, the usage will be limited to our intelligent deployment feature, ensuring the most accurate first-time deployments.

You’ve mentioned National’s digital platforms; what other software solutions do you offer?

Our clients have the choice to utilise our unique repair management solution, weDeploy. weDeploy is an application tool which connects insurers to our trusted network of repair centres across the UK to make direct bookings. Users can confidently provide information to their policyholders and rest assured vehicles are being repaired in the most suitable location and to the right specifications. Returning to the initial pain point of being unable to accept a claim within a reasonable timescale, weDeploy allows operatives to deploy a job whilst on the phone to a policyholder, capturing information at the first point of contact to secure the claim.

Does National have any future project developments lined up?

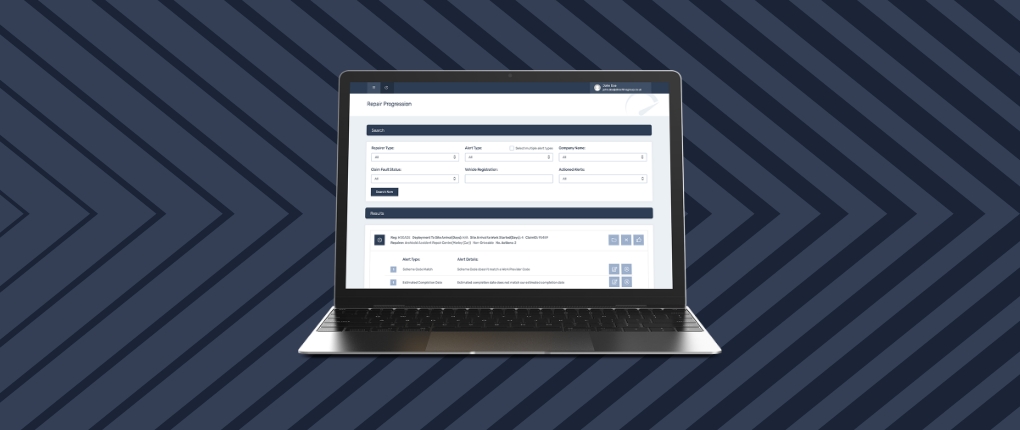

We’ve recently released our Progression 2.0 software, which offers a complete end-to-end claim solution from when a job is deployed rather than waiting for the vehicle to reach the bodyshop. Our Progression Team are responsible for monitoring the progress of individual repair journeys where the system proactively spots any issues or potential delays. This not only delivers significant benefits to our customers: reduced repair times, accurate data, transparent tracking, etc., these can be passed on to the policyholder for a better customer experience.

Do you believe these technical advances will help reduce the repair times?

Absolutely, we have already seen the results. We have over 500 repair centres in our National network, which our customers have instant access to for claim deployment. Progression 2.0 provides real-time monitoring of each repair job, which, along with our Progression Team, can ensure every job is managed effectively with minimal delays. It operates as soon as a valid deployment is made, capturing lead times from the first deployment step to give a true reflection of timings. This is vital for our customers to have such insights.

How has tech progressed National as a business over the last 14 years?

Since the acquisition of Silverstone Software, National has been able to develop our internal systems faster and within a controlled environment. We’ve been able to gather, utilise and test data to measure performance and provide solutions for our customers, automating everyday manual tasks, increasing productivity and customer satisfaction, and aiding progression with their own team by spotting and resolving issues first-hand. This is just the start for National and our customers; we’re dedicated to continually improving our technology and services to support the entire vehicle repair sector.

Introducing Progression 2.0: how our technology is streamlining the repair journey

Here at National, we support our customers by providing proactive rather than reactive solutions – reducing cycle times for policyholders, saving costs on replacement vehicles and offering real-time accuracy on the progression of a repair.

By continually monitoring and developing automotive software, we’ve created an advanced progression technology, Progression 2.0, to provide a complete end-to-end service to insurers, fleet managers, bodyshops and policyholders.

This industry-leading software now initiates checkpoints before a vehicle reaches a bodyshop. This offers a huge advantage as the Progression Team at National can monitor the entire repair journey, ensuring adequate resources and timescales are available, as well as preempting and resolving any potential hold-ups without impacting or delaying the repair.

Progression 2.0, the ultimate control in vehicle repairs

We’ve developed Progression 2.0 to include essential touchpoints that must be checked before a vehicle reaches a bodyshop. Confirming details such as capacity, capabilities, available parts and timeframes so insurers can deliver accurate communication to their policyholders at each milestone.

Behind the scenes, National has a dedicated Progression Team that monitors Progression 2.0 to track the movement of individual repair processes, ensuring checks and milestones are met within timeframes and rapidly resolving any issues to keep things moving. Essentially, project managing the entire process to provide an effective and profitable repair cycle service.

The benefits of Progression 2.0

By optimising the latest automotive software, your team can stay in the loop and one step ahead for your policyholders. Backed by a dedicated Progression Team for expert advice and fast-tracking solutions.

Benefits for our customers

- Tracking starts from the first deployment

- Quicker repair turnarounds

- Reassurance and accuracy at every stage

- Progression Team to monitor and resolve any issues

- Real-time updates and progression

- Control of the entire repair journey

- Reduces 3rd party claim confiscation

- Cost-savings due to reduced waiting times

Smart software for a faster repair – the outcome

National is dedicated to consistently improving our current software to enhance the vehicle repair process for all parties involved. Progression was our previous groundbreaking repair tracking tool, implementing a ‘key-to-key’ traffic light system, which would progress a claim once the policyholder handed their keys to a bodyshop through to when they received the keys back.

Moving forward, Progression 2.0 and our Progression Team can now track the entire repair journey. Identifying any issues early on and implementing resolutions to minimise any delays or unnecessary costs. This latest technology provides a complete full-cycle service for our customers and offers a predetermined and accurate outcome for every repair job

Progress further with Progression 2.0

To learn more about Progression 2.0, head to our dedicated technology page and discover how we can support your vehicle repair processes. Alternatively, contact the National team today and start maximising the benefits of Progression 2.0 in your operations.

The benefits of joining our Repairer Network

As one of the leading repair groups in the UK, National ARG works with multiple insurance companies to resolve daily vehicle claims and repairs.

We’ve built a responsive network of specialist repairers across the UK to offer customers a quick and reliable service. Each bodyshop has its valuable skillset and technology to deliver quality repair results.

6 Reasons Why You Should Join Our Network

01. Continual work into your bodyshop

Claim deployments are based on the customer’s vehicle type and location to pair them with the best repairer for their needs. This means you’ll receive first approval on any local requests. Accept as many jobs as your bodyshop capacity allows; this deployment workflow is constant and dependable.

02. Member benefits include

Along with the reassurance of consistent work for your business, joining the National network brings a range of additional benefits, including:

- Reduced BSI membership fees

- Support from National’s Head Office team

- Rapid payment of repair invoices to support your cash flow

- Up-to-date data and information on industry repairs

- Use of dependable software that requires no specialist equipment

03. Low referral fees

When you accept a vehicle repair, the job passes into your repair control, and we take a low, transparent and fixed fee for each referral given.

04. Access to industry-leading tech

Our software provides instant communication to provide real-time updates regarding parts, repairs and timelines. You can connect with us immediately with Live Chat services, in-house management support, and the latest Progression software. Improving efficiency, consistency and customer satisfaction.

05. Working with Bluechip insurance companies

We’re proud to say all our members are accredited to BS 10125. Not only will you also hold this accreditation, but you can rest assured you’ll be working with large Insurance and Fleet providers, providing them a direct first-class service.

06. Be a part of a community

We’ve dedicated years to working and building strong partnerships with our bodyshop network across the UK. With over 500 bodyshops already taking advantage of incoming work, we can confidently provide a suitable solution for any vehicle, model, make or type of damage. We offer training, software, great part rates and more.

Who can join the National Repairer Network?

Our aim is to improve the vehicle claims and repair process by working with reliable and reputable repairers throughout the UK. This includes repair centres with specific equipment and capabilities for particular repairs. With this in mind, we welcome repairers for cars, electric vehicles, motorhomes, HGVs and LCVs. Each member is measured against key performance indicators to ensure we’re all meeting the standards offered to our customers.

How do I join the Repair Network?

You won’t regret joining one of the largest repair networks in the UK. To submit your interest, head to our Join our Repairer Network page and complete the online form. One of the team will then contact you to discuss the next steps and provide further information.

New Co-members in National’s Customer Care Team

National Accident Repair Group are delighted to announce 9 new co-members to the Doncaster office, allowing for the expansion of the customer care team.

The new roles were created due to multiple new contract successes, where a key objective is to handle more claims within the existing claims centre. The newly onboarded clients will not only receive additional support from the newest co-members but will also benefit from the latest Progression software investments allowing for a more automated repair progression service. The internally used Progression software helps to monitor and improve vehicle repair times across a network of over 500 UK Bodyshops. Co-members are being trained in its operations and that will allow a more controlled vehicle repair, all coordinated from the Doncaster Head Office.

Furthermore, National’s Live Chat service has allowed customers and policyholders to directly communicate with internal teams in a more convenient way. The newest co-members will be using this software, alongside Progression, to give immediate repair updates when it’s requested.

Emma Barker, Claims Director for National Accident Repair Group said:

“We understand the importance of being able to give immediate repair updates to our clients and policyholders. Having dedicated teams to use our latest software innovations allows us to scale our operations and onboard new customers at a faster pace. That’s why we’re investing in our technology and Customer Care team, to offer unrivalled service and a more immediate response to queries and complications. We’re here for our customers and we’re very excited to scale our Doncaster operation.”

Welcoming the newest co-members to the Doncaster office is the first phase of National’s 2023 growth plan.