A Seamless Digital Motor Claims Journey – From Web to Deployment

In this ever-evolving digital age, the customer is king. Customers have never been better informed or more equipped to take advantage of the wide range of choices open to them.

To maintain their competitive edge, businesses of all shapes and sizes across every industry must understand the importance of a customer-centric, digital approach. Or risk leaving enterprises irrelevant and obsolete. At National, we’re no exception and fully embrace optimising digital solutions to benefit our clients and their customers through seamless motor claims.

The Impact Of The “Amazon Effect”

Convenience is at the heart of most customer service interactions. This phenomenon is known as “The Amazon Effect”; digital technologies have put the customer in the driving seat, and resultantly, the pressure is on businesses to provide a seamless and customer-friendly journey that makes consumers happy to return for more. The motor claims industry has the same expectations: why shouldn’t customers expect the convenience and user-friendliness from their motor insurance claims process as they would from their other online experiences?

In an era where consumers have become accustomed to having everything they want, from the name of a song they can’t get out of their heads to a new sofa at the touch of a button, there’s no reason why they should have to endure lengthy and confusing digital motor claims.

The Demand For Seamless Digital Experiences Will Only Increase

If you think providing a seamless digital claims experience for customers is the sole responsibility of a handful of forward-thinking service providers, think again. Digital convenience is no longer seen as a novelty by consumers; it’s a necessity. We’re all looking for ways to save time, so it’s incumbent upon businesses to bring their customers an easy and convenient solution, no matter what they’re ordering, booking, claiming or checking answers for.

With the cost of UK car insurance claims hitting over £19.27 billion in 2023, the demand for more convenient repair services is extremely high and will only increase over time.

Making Quick And Easy Claims On The Go

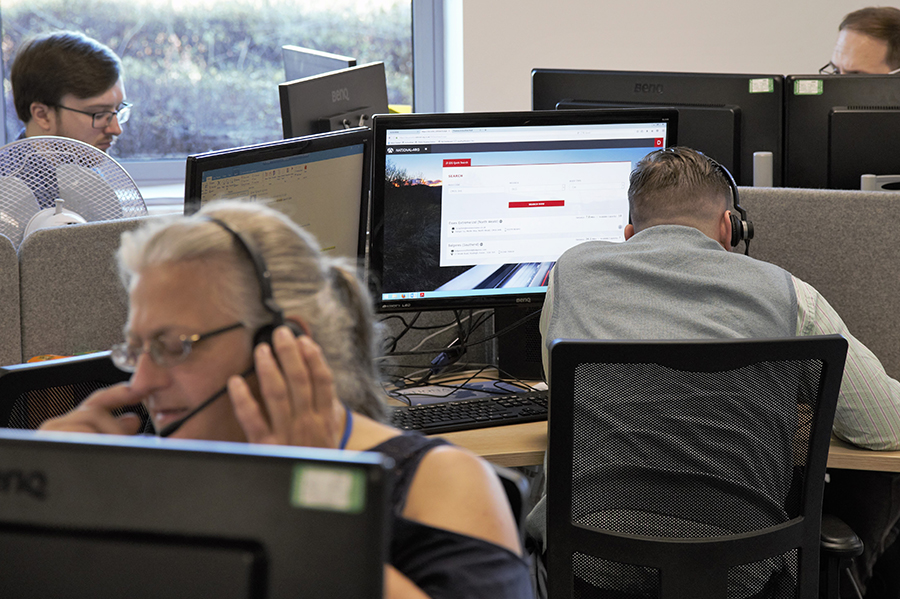

It’s not just about creating a quicker and easier claims process for digitally aware customers; it’s also about ensuring they can complete the entire process within a few taps. Mobile phones are by far the most vital piece of technology connecting you to your customers and influencing their overall experience; they’ve dramatically changed consumer behaviours as well as their expectations. For today’s customers, there is no time but the present. As such, providers must offer quick and easy ways to initiate a motor insurance claim on the go via their smartphones.

Mobile claims handling is rising across the industry at home and abroad. Insurance providers recognise the importance of collaborating with mobile app developers to create intuitive User Experience (UX) optimised mobile platforms. This allows their customers to initiate a claims process from anywhere at any time through their trusty smartphone. This not only facilitates customer convenience but empowers customers, giving them a feeling of ownership over their claims and being informed with regular updates at every key stage of their claim.

National Are Facing The Future With A Sense Of Readiness

Technology is never a stagnant pool. It’s a roiling and turbulent sea upon which even the most forward-thinking and tech-savvy enterprises can often struggle to stay afloat. As such, while it’s essential to leverage mobile technology to facilitate user-friendly and seamless digital motor claims, it’s also vital that providers keep an eye on future and potential developments.

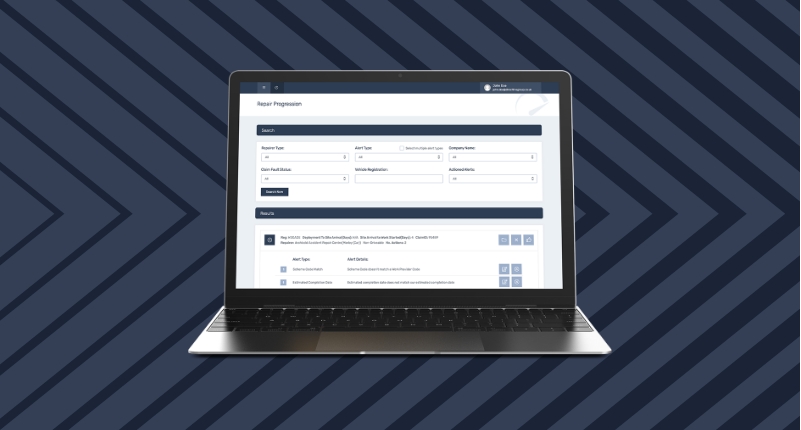

At National, we’ve invested in vital software, such as our Progression 2.0 solution, along with an expert team behind it. This allows us to support motor claims from the moment they’re logged through to completion, proactively spotting and preventing any issues that could cause upset, delays or unnecessary costs.

How Does The National Accident Repair Group Help Vehicle Claims?

Businesses are already experimenting with leveraging virtual and augmented reality software (collectively called Extended Reality or XR) to create more immersive customer interactions. Indeed, efficient XR experiences will create a new foundation for how enterprises interact and communicate with customers across the motor industry. But, whatever technological changes are wrought in our sector, the onus is on delivering a seamless experience that puts claimants in the driving seat and keeps them informed throughout every stage of the claims process.

At National, automatic deployment systems are available as a bolt-on to the digital claim journey. The claimant can deploy an ‘approved claim’ for vehicle repair within 4 simple steps using a computer or mobile phone. National’s technology department is here to help insurance and fleet customers by implementing and supporting a full digital claim.

Talk to National about their existing systems and how they can be used to create a seamless claims journey, from web to deployment.