Improving Customer Claims Management with Customer Experience

The claims process is arguably the single most important task any insurance company has to deal with. This is the ‘make or break’ moment for many customers, the point at which they decide if an insurance company is the right fit for them. Until the point of needing a claim, price is the primary decision by which people will select their insurer. Still, in the event of a claim, a customer’s personal experience of the process becomes a vital factor.

There are several different ways insurance companies can improve the customer experience of the claims process. By investing in and implementing positive claim management techniques, higher levels of customer satisfaction — and thus higher levels of customer retention — can be achieved.

So, how can the customer experience of insurance claims management be improved?

The Impact of Overlooking Customer Experience

Numerous factors should be considered within claims management, and many insurers make the mistake of valuing these areas over the customer experience. This can be a serious mistake. If a customer is unhappy with the experience they receive, they are likely to discontinue their business — but that’s just one problem. There is always the chance unhappy customers will “spread the word” about the poor service they received. This could mean writing on internet forums, using social media, and broadcasting their anti-your-company message far and wide.

Given the scope available to dissatisfied customers, any insurance company must genuinely value the customer experience and put it at the forefront of the claims process. It is one thing to accept these issues might happen; it’s another to see this kind of negative feedback as a genuine threat and something to be taken seriously.

How To Improve The Claims Customer Experience

Consider yourself as the customer: what’s important to you when processing a motor repair claim, and what stands out as exceptional service? Making you feel confident in the process if it ever happens again and sharing your seamless experience with others. There are several steps insurers can put into place to increase customer satisfaction and, therefore, the entire claims management process.

Invest in technology

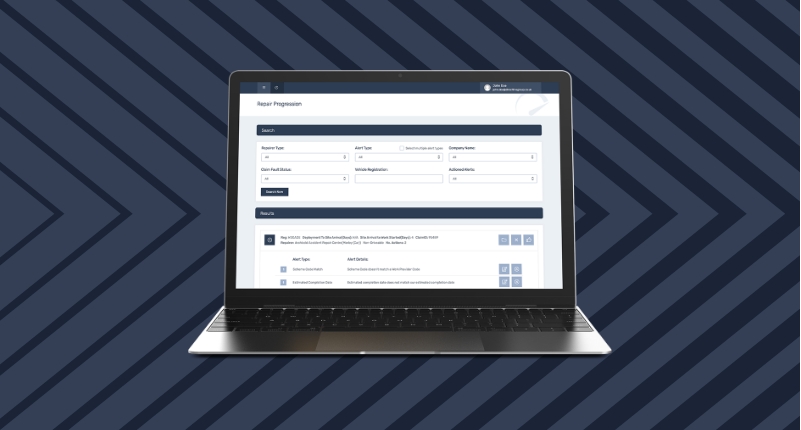

Software, apps and chatbots can all positively contribute to digital motor repair claims. From quick queries and deploying a claim to tracking activity and collecting the keys, the right technology software enhances a customer’s experience at every step of the repair journey.

In addition, it helps insurers and repairers track real-time claims and analyse performance, providing better accuracy for timeframes and pricing, as well as any improvements for future claims.

Create an easy and convenient process

Any fault to a vehicle is highly frustrating to its owner, but to then deal with a complicated and time-consuming claims process just adds unnecessary stress. Like everything else, customers seek a quick and convenient solution to their motor problems.

Streamlining your claims process via accessible technology and user-friendly processes provides a smoother service to customers.

Offering reassurance and expertise

Correct data capture from insurers and repairers enables you to provide instant and accurate solutions from the start. By knowing the capabilities and capacity of your repairers, you can allocate the best fix based on the type of car, fix, location and time constraints. Providing reassurance to motorists that their repairs are in the hands of those who know what they’re doing.

Partner with EV repairers

With the increase in the number of EV and hybrid vehicles, this will naturally reflect in the types of claims being processed. EV repairs require specific skill sets, parts and facilities, which not all repairers may have. By networking with reliable EV repairers, you’re offering more solutions to your customers for a quick and successful solution.

Improved communication choices

In the modern world, customers are no longer satisfied with a long wait on hold or a promise of a callback that never comes. They want to receive quick, efficient service from their insurance company at each stage of the claims process.

This means insurance companies need to implement various communication options for customers going through a claim; at the very least, social media, email, and telephone options should be available. Companies could also consider self-service portals online, where customers can check the status of their claims without contacting a company representative directly.

Up-to-date information

Available communication is only half the solution; the other half is ensuring the information they’re seeking is correct and up-to-date. Transparency between repairers and claimants is essential. Customers don’t want to be confused by industry jargon or receive unexpected costs at the end of the process. By utilising the latest industry software, insurers can provide real-time data about a claim, often highlighting and resolving any issues before the customer is even aware.

Business practice management (BPM) necessities

A key component of effective customer experience management is the integration of this concern into the BPM that a company is using. If a BPM has been well-designed and structured to reflect customer needs, it can help manage customer interactions and improve customer service as a result.

The main advantage of BMP processes is their ability to monitor and improve the speed and efficiency of a claim from start to finish, which in turn helps to deliver a more seamless experience to the customer.

The advantage of automation

Certain aspects of the claims process can be automated, which can incredibly benefit the customer. What customers want from a claims process, above all, is speed; a lengthy delay for a claim to be processed is a surefire cause for a complaint if it is not addressed. Automating basic tasks in the claims process can allow processors and adjustors to focus on activities which can deliver a better experience to the customer, safe in the knowledge that the claim will progress in the background thanks to automation.

Additionally, automation can also assist with improving the customer experience by handling straightforward claims in the most efficient timeframe. Simple claims should not demand the time and attention of specialist workers; instead, BPM platforms and automation should be able to guide basic claims to a conclusion as quickly as possible. Not only is this outcome positive for the customer of the simple claim, but it is also beneficial for customers with more complex claims — as their claims can receive more attention from adjustors, who have more time without the distractions of basic claims.

Stay one step ahead

As insurers, you can boost the customer experience by being mindful of internal and external factors which could increase or impact motor claims. Staying in the loop of industry insights or monitoring weather conditions can help you prepare for possible peaks in claims or incoming queries. Being aware of these means you can put things into place to limit inconveniences and reassure customers.

Why Customer Experience Matters

The customer experience is an essential component of effective claims management; thus, it should be at the forefront of considerations when making decisions in this area. However, customer experience is not the only important part of claims management — cost-effectiveness, productivity, and reducing claim timescales are also incredibly important. By combining work in these areas with a dedication to improving the customer experience, you should be able to deliver an effective claims management solution that suits you and your customer base.